The fuel prices in Pakistan are a frequent headline because any change affects transport, food costs and inflation. This article explains causes of fuel price hike Pakistan, the mechanics behind the petrol price Pakistan 2025, how the petroleum levy Pakistan and taxes influence retail rates, and how OGRA notified prices and government policy shape what you pay at the pump.

1 — How petrol & diesel prices are calculated in Pakistan:

Pakistan does not set fuel prices arbitrarily. The usual process (operationalised via OGRA notifications and Finance Division decisions) is to compute the cost of imported fuel (CIF — cost, insurance, freight), add landing, refining or supplier margins, then apply customs duties, petroleum levy (PL), sales tax / GST (if applicable), and distributor/retailer margins. The resulting figure is the notified retail price every fortnight. The Oil & Gas Regulatory Authority (OGRA) publishes these notified petroleum prices after the Ministry of Finance/Power Division reviews recommendations.

Why fortnightly? Pakistan’s system adjusts prices every two weeks so that changes in global crude, freight and exchange rate are passed to consumers (and government revenues) relatively quickly. This reduces accumulation of arrears and sudden fiscal shocks, but it also means frequent price volatility for households and businesses.

2 — The role of OGRA, Finance Division and the cabinet:

- OGRA calculates producer/importer recommendations and publishes the notified price schedule. These notifications tell fuel retailers the ceiling retail prices for the next fortnight.

- Finance Division / Cabinet decide on taxation elements (petroleum levy rates, whether to apply GST) and overall fiscal policy; these choices can override or significantly alter final retail prices. Recent months have seen the federal government use PL adjustments as a revenue tool.

Example: a notification published in mid-July 2025 raised petrol and HSD by several rupees per liter as the government reconciled global price pressures and fiscal needs. The OGRA notification and Finance Division press release are the official references for such changes.

3 — Key components of pump price: CIF, freight, duties, petroleum levy & GST:

A typical breakdown (simplified) looks like this:

- CIF (Cost, Insurance & Freight): Price paid to sellers abroad plus shipping & insurance. This follows global crude and product prices (Brent/swap price) and freight rates.

- Landing & handling costs: Unloading, port charges and local logistics.

- Customs duty & import tariffs: Levied on imported products.

- Petroleum Levy (PL): A major fiscal instrument collected per litre. Changes in PL directly affect retail price. Recent policy has used PL increases to boost revenue.

- Sales Tax / GST: The government may impose GST on petroleum products; proposals and temporary changes have appeared in budget debates.

- Distributor/Retailer margins: Fixed or regulated margins added to ensure supply chain viability.

- Subsidies/adjustments: Occasionally the government pays or removes subsidies, affecting final price.

Because PL and taxes are volume-based (per litre) and duties are ad-valorem or fixed, small changes in CIF or large changes in PL/GST can produce sharp pump price moves.

4 — Main causes of fuel price hikes (global & domestic):

Fuel prices in Pakistan rise because of several interacting causes:

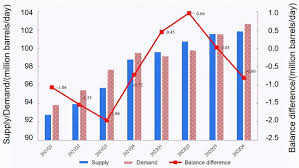

a) Global crude & product prices:

Crude oil price swings (Brent/WTI) drive the CIF. Geopolitical events (Middle East tensions), OPEC+ production cuts or supply disruptions push global prices up; when they fall, Pakistan’s CIF follows with a lag. Recent volatility in 2024–25 caused several fortnightly adjustments.

b) Exchange rate / PKR depreciation:

Petroleum imports are paid in USD. A weaker Pakistani rupee makes imported fuel more expensive in PKR terms even if dollar prices are stable. Currency depreciation has been a persistent pressure in Pakistan’s fuel-cost inflation. IMF/World Bank analyses link reserve pressures and exchange rate shifts to higher domestic fuel prices.

c) Petroleum Levy (PL) and taxes:

Governments often raise the PL (a per-litre charge) to boost revenue. In 2025, authorities adjusted PL levels and removed earlier caps, increasing the levy burden — a direct cause of higher pump prices. Policy choices on whether to apply GST or change PL have immediate effects.

d) Freight, insurance and shipping constraints:

Global freight spikes (post-pandemic logistics crunches, Suez transits, tanker availability) raise CIF. Even small freight rises matter because Pakistan is highly import dependent for refined products.

e) Local refining capacity & regulatory constraints:

Pakistan’s domestic refineries operate below desired capacity and rely on imports of some products. Debates over deregulation, refinery upgrades and local purchase rules affect supply margins and costs. Reuters reported refiners warning that deregulation plans might threaten upgrades — an issue for long-term local price stability.

f) Market structure and temporary supply tightness:

Parallel imports, logistical delays, or mandated local purchase rules can cause short-term supply tightness and price spikes, especially in provinces where distribution bottlenecks exist.

5 — Petroleum Levy (PL): history, recent changes and why it matters:

The Petroleum Levy (PL) started as a fiscal measure to collect extra revenues. Over time, its level and caps have changed: sometimes the government capped PL at a certain amount per litre; at other times it increased PL to raise revenue targets. In 2025, reports indicated plans to raise the PL and possibly add GST on petroleum products to shore up revenues — moves that translate directly to higher retail prices.

Impact: PL raises are regressive — low-income households spend a larger share of income on fuel and transport. Because PL is per-litre, it affects all consumers equally per quantity but not proportionally to incomes.

6 — How the exchange rate amplifies price changes:

When PKR weakens against USD, every gallon/litre imported costs more in local currency. Even if global crude softens, a sharp rupee depreciation can offset gains and leave CIF elevated. Pakistan’s foreign reserves, balance of payments and IMF conditionalities influence central bank interventions and exchange rate stability — all indirectly shaping fuel prices. IMF country reports highlight macro vulnerabilities that translate into price volatility for commodities like fuel.

7 — Local refineries, deregulation debate and long-term supply costs:

Pakistan has domestic refineries but they require upgrades (environmental and technical). OGRA and policy proposals have at times sought to deregulate fuel pricing to let market forces set prices and encourage competition. Domestic refiners have warned that deregulation could jeopardize planned $5–6 billion upgrades unless measures protect refinery viability — a tradeoff between short-term price relief and long-term energy security/upgrades. Reuters covered this industry debate and the risk profile for refinery investments.

8 — Fiscal pressures, IMF programs and why governments adjust fuel taxes:

Fuel taxes and PL are often used to meet fiscal targets. For countries like Pakistan, meeting IMF program conditions or budgetary revenue targets sometimes requires raising non-tax revenues (like PL) or applying GST to previously exempt items. These actions are politically sensitive because higher fuel taxation increases headline inflation. Profit / Pakistan Today and Business Recorder reported on the interplay between revenue targets and PL changes in 2025.

9 — Real-world timeline: recent price moves (examples from 2025):

- July 16, 2025: Government hiked petrol by ~Rs5.36/litre and HSD by ~Rs11.37/litre for the next fortnight. OGRA published the notified prices.

- Early August 2025: Some notifications showed petrol cuts at other fortnights (reflecting global dips), while diesel moves varied—illustrating the fortnightly pass-through mechanism.

These fortnightly swings are why households feel constant price pressure and why businesses hedge fuel costs where possible.

10 — Inflationary and economic consequences of fuel price hikes:

Fuel price increases ripple through the economy:

- Transport costs rise, increasing food and goods prices (inflationary impact). Dawn and other outlets document the inflation pass-through from fuel to consumer prices.

- Production costs increase for manufacturing and agriculture, possibly reducing competitiveness.

- Public transport and logistics become costlier, affecting supply chains and small businesses.

- Social stress: higher fuel costs affect household budgets, often prompting public protests or policy reversals.

Studies show that fuel price spikes contribute to headline inflation and can affect monetary policy decisions (interest rates, FX interventions). IMF analyses discuss such macro links.

11 — How households and businesses cope (practical tips):

For households:

- Use fuel-efficient driving and maintain vehicles for better mileage.

- Carpool, use public transport where feasible.

- Plan trips to minimize fuel use.

For businesses:

- Lock in fuel via hedging contracts if available.

- Optimize logistics (route planning, consolidation).

- Invest in fuel-efficient vehicle fleets or consider electrification where practical.

These measures can alleviate some short-term pain, but systemic fixes need policy action.

12 — Policy options to reduce volatility and protect consumers:

Policymakers can consider a menu of options:

- Gradual subsidy targeting: Instead of blanket subsidies, target vulnerable households with cash transfers to offset high fuel costs.

- Stabilisation fund: Use a fuel price stabilisation fund to smooth short-term global price swings for consumers.

- Phased deregulation with safeguards: If moving to market-determined prices, combine it with a transparent framework and refinery support to encourage investment. Reuters covered concerns that abrupt deregulation might hamper refinery upgrades.

- Improve local refining capacity: Incentivise investment to reduce import dependence.

- Diversify energy mix: Accelerate renewable energy, reduce oil dependency in power sector and transport electrification to cut long-run exposure to oil price volatility.

- Exchange rate and reserve management: Strengthen foreign exchange buffers to avoid rupee shocks translating into immediate fuel price spikes. IMF/World Bank advice and conditionality often emphasize reserves and fiscal stability.

13 — Politics, timing and communication: why price changes feel abrupt:

Even if the calculation is technical, price changes are political decisions: deciding the PL level, GST application, and timing are fiscal policy moves. Governments may delay increases for political reasons or accelerate them when under fiscal pressure. Media coverage often asks why prices rise even when global oil softens — the answer lies in a mix of tax moves, rupee depreciation and time-lagged pass-through. Profit and other sources have analysed such apparent mismatches between global trends and local hikes.

15 — Bottom line and conclusion:

Fuel prices in Pakistan are the outcome of global markets, currency dynamics, domestic taxes (especially PL), regulatory notifications by OGRA, and local supply constraints. Short-term hikes are usually explained by CIF spikes or levy/tax changes; long-term relief requires investment in refineries, an improved fiscal strategy (less reliance on volatile levies), and diversifying energy sources away from imported oil. Transparent fortnightly notifications make the process visible, but policy choices (PL, GST) remain the lever that governments use — at the cost of inflation and public hardship.

16. External links & sources:

- OGRA — Notified Petroleum Prices. OGRA

- Dawn — reporting on price changes. Dawn+1

- Pakistan Today / Profit — analysis on hikes & government rationale. Profit by Pakistan Today+1

- Business Recorder — GST and PL reporting. Business Recorder

- Reuters — refinery/deregulation debate and investment risks. Reuters

- IMF Pakistan country report (macro context). International Monetary Fund

Leave a Reply