The debate iOS vs Android 2025 is more than brand loyalty — it’s about which platform delivers better iOS 2025 features and Android 2025 features, which ecosystem provides the best developer and app experience, and where mobile OS market share 2025 is shifting. This long-form guide breaks down performance, AI integration, privacy, app revenue, hardware variety, regional adoption and the hard-to-measure ecosystem advantages so you can decide which is the best mobile ecosystem 2025 for your needs.

1 — Executive summary:

- Market reach: Android remains the global volume leader; iOS keeps a strong high-value user base.

- AI & features: 2025 is the year of on-device and assistant-led experiences — Apple’s Apple Intelligence and Google’s Gemini are now central to each OS’s strengths.

- Privacy & security: Apple still emphasizes privacy as a pillar; Android has improved privacy controls and deep Gemini integration but relies on a diversity of OEMs.

- Apps & revenue: iOS continues to generate more app revenue per device, though Google Play’s install base is larger.

- Winner (short): There is no single winner — iOS leads in polished integration, privacy messaging, and high-value apps; Android wins on variety, innovation velocity, and global reach. The “best” ecosystem depends on what you value most.

2 — Market share & economics: who actually “wins”?

Users and share:

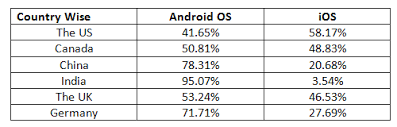

As of mid-2025, Android holds roughly ~72% of global mobile OS market share while iOS sits around ~27% (these figures fluctuate by region and source). Android’s dominance is strongest in Africa, South Asia, and Latin America; iOS leads in revenue share and in many high-value markets like the U.S., Japan and parts of Western Europe.

App revenue and developer economics:

Apple’s App Store still drives more revenue worldwide than Google Play, with estimates showing Apple store revenue significantly higher in 2025 (Apple often generates roughly double Google Play revenue depending on the metric/source). That makes iOS an attractive monetization platform for premium apps and in-app purchases; Android’s huge install base is ideal for ad-driven apps and reach.

Implication: If your priority is broad reach and diversity of devices, Android is the winner. If you prioritize monetization per user and a consistent high-value audience, iOS leads.

3 — Core feature comparison: performance, updates, UI, and customization:

System performance & chips:

- iOS 2025: optimization across Apple’s silicon (A-series, M-series where applicable) gives iPhones consistent single-chip performance and excellent real-world efficiency. iOS updates are tightly coupled with hardware, resulting in smooth UI and long OS support cycles.

- Android 2025: runs on a huge variety of silicon (Qualcomm Snapdragon, Samsung Exynos, Google Tensor, MediaTek Dimensity). Flagship Androids match or exceed iPhone raw performance in many multi-core and GPU tests, while midrange Androids offer extreme value. The challenge: OEM customization leads to heterogeneous update speeds.

OS updates & support:

- Apple: long-term OS support across many iPhone models (iOS 19 in 2025 continues that trend). That makes iPhones attractive for users who keep devices 4–6 years.

- Android: Google and some OEMs (Samsung, Google Pixel) improved update commitments; Google’s Android program and Project Mainline have narrowed the gap, but fragmentation still affects smaller OEMs.

UI & customization:

- iOS emphasizes simplicity and consistency; deep integration with Apple services (iCloud, FaceTime, iMessage) is a big draw.

- Android delivers customization: widgets, third-party launchers, system tweaks and OEM extras (One UI, OxygenOS, MIUI). For power users who want to configure their phone environment, Android remains superior.

4 — AI & smart features: Apple Intelligence vs Google Gemini:

2025 is (arguably) the year AI became native to mobile OS UX.

Apple Intelligence:

Apple positioned Apple Intelligence as a privacy-focused assistant integrated across iPhone, iPad, Mac and Vision Pro — capable of summarizing content, drafting messages, and surfacing personal context while promising on-device processing and privacy protections. Apple’s pitch is AI that “respects your data.”

Google Gemini & Android:

Google embedded Gemini across Android for features like image understanding, Magic Editor, live translations, contextual actions and accessibility improvements (TalkBack enhancements). Google’s approach emphasizes powerful cloud/edge AI plus local models (Gemini Nano) on Pixel and partner chips (Tensor G5). Google often leads with experimental, rapidly iterated features.

Who’s winning in AI?

- Apple: smoother integration, privacy default, and cross-device continuity. Best for users who prefer curated, reliable AI features in everyday tasks.

- Google: faster feature velocity, more experimental tools (image Q&A, Magic Cue), and wider partner ecosystem. Best for power users who want cutting-edge AI tools on device.

5 — App ecosystems, revenue and developer priorities:

Apps, quality and exclusives:

- iOS historically gets many premium apps, often first; app discovery on iOS tends to favor paid/subscription models.

- Android has more apps overall due to many device variants and markets, and strong support for sideloading and alternative app stores in some regions.

Developer economics:

- If you’re an indie dev targeting paid users and subscriptions, iOS often gives better LTV (lifetime value) per user. If scale and ad-driven revenue matter, Android offers more installs and flexibility. Developer toolchains (Xcode vs Android Studio) both matured; cross-platform frameworks (Flutter, React Native) bridge gaps.

Regulations and alternative stores:

Regions and regulators (EU, India, South Korea) have pressured both Apple and Google to open distribution and payment options. Android’s more open model gives developers more distribution routes; Apple has been adapting to legal changes but remains more closed. Both ecosystems are evolving under regulatory scrutiny.

6 — Privacy, security and regulations in 2025:

Apple’s privacy positioning:

Apple continues to emphasize privacy as a key differentiator — on-device ML, limited cross-app tracking, privacy labels and App Tracking Transparency all reinforce trust for privacy-sensitive users. Apple Intelligence claims to process as much as possible locally.

Android’s privacy improvements:

Android rolled out privacy features and safer defaults (Android 15/16 additions) while integrating Gemini with accessibility and privacy-conscious modes. OEMs vary — Pixel and Samsung often match or exceed Apple in security features, but Android’s openness introduces more variability.

Regulatory pressures:

Antitrust and digital markets regulations are forcing both ecosystems to open up in areas like in-app payments and third-party app stores; these policies often affect developer economics more than core user experiences.

7 — Hardware, variety and price tiers:

Android’s strength: breadth of hardware:

Android’s massive advantage is choice: foldables, gaming phones, budget powerhouses, camera-centric flagships and region-specific devices. This variety means consumers can find a phone tuned to their budget and needs.

iPhone’s strength: integration & resale:

Apple offers a tight hardware+software play and strong resale values. While iPhones are premium priced, Apple’s control over the stack yields consistent experience across devices.

Practical takeaway: Want many form factors (foldable, gaming), advanced hardware options, or aggressive price points? Android. Want polish, continuity, longevity and resale? iOS.

8 — Enterprise, services, and cross-device continuity:

- iOS excels with device management (MDM), enterprise apps, secure communication (FaceTime/Business), and cross-device workflows (iPhone→Mac).

- Android has closed the enterprise gap with better management tools and more OEM choices for enterprise deployments; ChromeOS + Android combo remains strong for education.

Services like Apple Arcade, Apple Music, iCloud vs Google One, YouTube Premium and Google Workspace factor into the ecosystem lock-in: choose an OS that matches the services you already rely on.

9 — Regional differences: where Android dominates and where iOS leads:

- North America & Japan: iOS has strong market share and high ARPU (average revenue per user).

- South Asia, Africa, Latin America: Android dominates due to low-cost devices and telco partnerships.

- Europe: mixed; premium segments favor iOS, but Android broadly leads in total devices.

This regional split explains why global stats (Android volume leader) and revenue stats (iOS monetization leader) can both be true simultaneously.

10 — Gaming, AR/VR, and content creation:

- Gaming: High-end Android (Snapdragon, AMD/Adreno GPUs) and iPhone both deliver console-level mobile gaming. Android offers more hardware diversity (144Hz screens, vapor chambers), while iOS benefits from consistent performance and optimized titles.

- AR/VR & Spatial computing: Apple’s Vision Pro and Apple’s ecosystem focus on spatial experiences, while Android partners (Meta, Google) power other AR integrations. Cross-device AR maturity is still nascent but advancing rapidly.

- Content creation: iPhones lead for mobile video workflows (ProRes, Final Cut), while Android flagships offer raw capture modes and camera hardware favored by photographers.

11 — Battery life, power efficiency and real-world performance:

Real-world battery performance depends on SoC efficiency, display type (OLED high refresh rates), and software. Apple’s vertical optimization often yields excellent per-watt performance; Android flagships counter that with larger batteries and fast charging. In 2025 both ecosystems are competitive; your choice will hinge on model, usage patterns, and charging expectations.

12 — Future roadmap: what to expect beyond 2025:

- More on-device AI: Both Apple and Google will push local AI capabilities to reduce latency and increase privacy. Expect richer assistant features, image understanding, and smarter accessibility.

- Foldables & alternative form factors: Android OEMs will expand foldable and dual-screen lines; Apple may explore larger formats in some form over the longer term.

- Regulatory changes: More open app ecosystems, alternative billing options and regional compliance will reshape distribution.

- Interoperability standards: Cross-platform protocols (RCS, WebAuthn, passkeys) will make switching smoother.

13 — Buying guide: which ecosystem should you choose?

Use this quick checklist:

- If you value privacy, longevity, and video/pro workflows: pick iOS.

- If you value hardware choice, customizability, and better price variety: pick Android.

- If you are a developer: consider revenue model (iOS for subscriptions/premium, Android for installs/ad models) and target market.

- If you live in a region where carrier deals or device diversity matter: Android will likely give you more choices.

15 — Final verdict: no single “winner”:

In 2025 the race between iOS vs Android is no longer a zero-sum game. Both ecosystems have vastly improved and specialized:

- iOS: polished integration, privacy-first AI, strong monetization and cross-device continuity. Great for creatives, enterprise users, and buyers who value longevity.

- Android: unmatched variety, faster hardware innovation, powerful AI features (via Gemini), and unbeatable reach. Great for tinkerers, global markets and those who want choice.

Your decision should be driven by which features you actually use daily (camera, video, apps, services) and where your friends/family/business are (ecosystem lock-in still matters). Both ecosystems are winning — in different ways.

16. Internal links:

- Best camera phones 2025 —

/best-camera-phones-2025 - Apple iPhone 17 Pro Max price in Pakistan 2025 —

/apple-iphone-17-pro-max-price-in-pakistan-2025 - 5G connectivity in Pakistan —

/5g-connectivity-and-availability-in-pakistan

17. External links:

- iOS 19 coverage (AppleInsider). AppleInsider

- Apple Intelligence — Apple. Apple

- Google Gemini / Android AI integration — Google Blog. blog.google+1

- Android new features & Android 15 notes — android.com & Google Blog. Androidblog.google

- Mobile OS market share (StatCounter). StatCounter Global Stats

- App revenue and market analysis (Business of Apps / HubiFi). Business of AppsHubiFi